lhdn tax relief 2016

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. This relief is applicable for Year Assessment 2013 and 2015 only.

Malaysia Income Tax Guide 2016

102021 29122021 - Refer Year 2021.

. Personal Tax Relief 2021. In Budget 2020 an additional lifestyle tax relief for the purchase of personal computer smartphone or tablet for self spouse or child was added and extended to Year of Assessment 2021. Some types of assistance include life insurance medical expenses for parents individual education fees the purchase of a laptop or smartphone.

Limiting Base Erosion Involving Interest Deduction and Other Financial Payments BEPS Action 4 - 2016 Updated. ORANG RAMAI DIALU-ALUKAN UNTUK MENYERTAI KONSULTASI AWAM DENGAN HASiL. On the First 5000.

Company Tax Deduction 2021. How To Pay. APPLICATION GUIDELINES FOR NEW DOMESTIC HELPER.

Superceded by the Public Ruling No. You have to spend that amount first. S2 of Companies Act 2016.

Personal income tax relief letter from Inland Revenue Board of Malaysia LHDN-salary above RM1000000. EPF Rate variation introduced. New company LLP that established within July 2020 to December 2022 are eligible for a tax rebate up to RM 60000 in total.

Appeal Against An Assessment And Application For Relief. Cap at 70 of revenue Manufacturers also have something similar call ITA Sos I kerja kilang This post has been edited by 9m2w. Official PCB Calculator from LHDN Hasil.

Tax relief specifically up to 48 billion capital allowance. Ini bukan tax release. Under the PENJANA recovery plan there is an increase in income tax relief for parents on childcare services expenses from RM2000 to RM3000 which applies.

Statistic of Online Services Transaction Immigration Department Year 2016. Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe register private vehicle under. Increment and Reduction in income tax.

Assessment year 2023 just do the same as previous step with your estimated 2022 total income but choose 2022 for PCB year. Heres the full list of income tax relief 2021 Malaysia. 30 Apr 2016.

Special Income Remittance Program PKPP For Malaysian Tax Resident With Foreign Sourced Income. This is a bigger concern if you are filing for a business income tax as there are specific categories of expenses that businesses are allowed to claim tax deductions. The Simple PCB calculator takes into account of RM2000 special tax relief limit that capped at income RM8000mth.

All business records expenses receipts for personal reliefs will have to be kept for audit purposes for a period of 7 years. Update Your Latest Mailing Address to LHDN with e-Kemaskini. According to Short-term Economic Recovery Plan Penjana newly established SME can get up to RM 20k tax rebate for the first three years.

Introduced optional RM2000 special tax relief switch to comform to LHDNs standard. 11 April 2016 EiE. Introduced optional RM2000 special tax relief switch to comform to LHDNs standard.

Restriction On Deductibility Of Interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction On Deductibility Of Interest Rules 2019 PU. Oct 5 2022 0622 PM. Guide To Using LHDN.

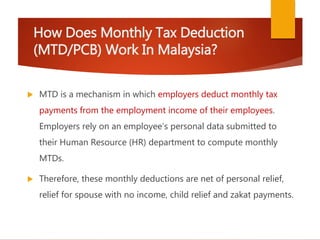

Tax Identification Number TIN Tax rebate for set up of new businesses. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. EPF Rate variation introduced.

To get this tax rebate the company must be SME and is newly establish. Tax Treatment Of Research And Development Expenditure Part II Special Deductions. Unlike previous years the new e-filing form will actually provide you with additional information on each relief if you hover your cursor over the green Info button.

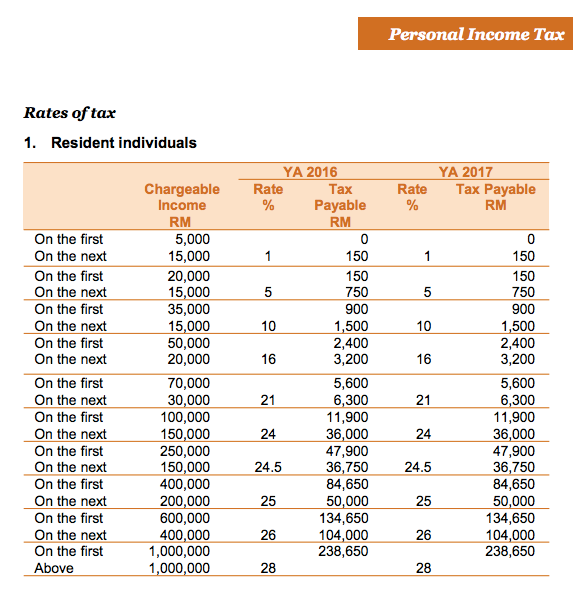

Increment and Reduction in income tax. Calculations RM Rate TaxRM A. 1 January 2010 Petroleum tax PU.

The Simple PCB calculator takes into account of RM2000 special tax relief limit that capped at income RM8000mth. 14 FOURTEEN WORKING DAYS. On the First 5000 Next 15000.

Once you have submitted the form to LHDN and a copy to your employer your employer will have to remit the amount deducted to Inland Revenue Board Malaysia IRBM also known as LHDN every month in accordance with Income Tax Deduction and Remuneration Rules 1994. Income Tax Filing for Partnerships. Bagi meningkatkan ketelusan dan penglibatan awam dalam pentadbiran cukai langsung Lembaga Hasil Dalam Negeri Malaysia HASiL mengalu-alukan orang ramai untuk menyertai Konsultasi Awam.

Likewise if you need to estimate your yearly income tax for 2022 ie. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. If you are part of a partnership business your partnership income will be stated on Form CP30 which is issued by the precedent partner to all partners.

Automatic Exchange of Information AEOI Hidef CheckSchema. Income Tax Restriction. Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe register private vehicle under.

And you then deduct from your revenue for tax purpose calculation. Resetting number of children to 0 upon changing from married to single status. How To Pay Your Income Tax In Malaysia.

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Statistic Of Online Services Transaction For Year 2017. A tax deduction is similar to a tax relief where it reduces your chargeable income.

This is where you declare your purchases from last year that provide tax relief. International Exchange of Information. Heres How A Tax Rebate Can Help You Reduce Your Tax Further.

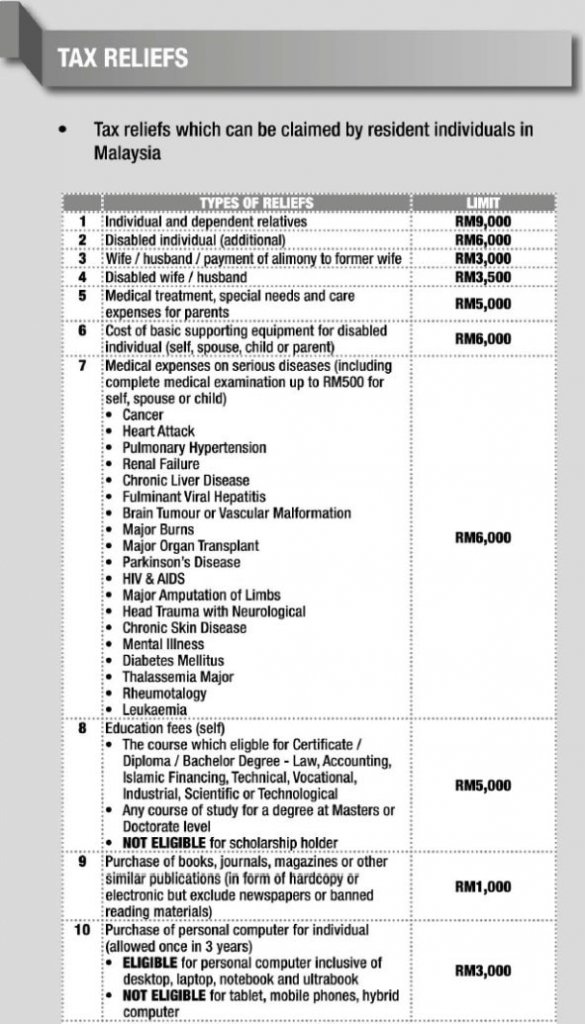

Resetting number of children to 0 upon changing from married to single status. Kalkulator PCB - Lembaga Hasil Dalam Negeri. Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia LDHN whereby taxpayers are allowed to deduct a certain amount of money from their income tax.

PT Bank Maybank Indonesia Tbk Maybank Indonesia or the Bank today announced that net profit after tax and minority interests PATAMI for the first quarter ended 31 March 2017 was 104 higher at Rp4901 billion compared with the previous corresponding period 31 March 2016 on the back of higher Net Interest Income NII. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. 30 Apr 2016.

Guide To Using LHDN e-Filing To File Your Income Tax. Guide To Using LHDN e-Filing To File Your Income Tax. How Does Monthly Tax Deduction Work In Malaysia.

Tis The Season To File Your Taxes Again So We Thought We D Help You Out With E Filing Rojakdaily

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Personal Income Tax Guide In Malaysia 2016 Tech Arp

Tax Season 11 Critical Deductions You Should Know Financetwitter

Lhdn Tax Payment Codes Ccng Chartered Accountants

How To Step By Step Income Tax E Filing Guide Imoney

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Ctos Lhdn E Filing Guide For Clueless Employees

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

Double Deduction For Scholarships Provided By Companies May 12 2022 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Do I Still Need To Pay Tax If I Am Paying Pcb Every Month Tax Updates Budget Business News

Newsletter 11 2019 Analysis Of Direct Tax Collection For 2018 Page 002 Jpg

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Be2016 For Jan 2018 Past Year Q1 Section B Basic Particulars 1 Name As Per Identification Studocu

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Personal Income Tax 2016 Guide Part 7

Tweets With Replies By Amengo Management Amengobiz Twitter

0 Response to "lhdn tax relief 2016"

Post a Comment